Some Ideas on Thomas Insurance Advisors You Should Know

Wiki Article

See This Report on Thomas Insurance Advisors

Table of Contents8 Simple Techniques For Thomas Insurance AdvisorsThomas Insurance Advisors Things To Know Before You Get ThisThomas Insurance Advisors Things To Know Before You Get ThisThe smart Trick of Thomas Insurance Advisors That Nobody is Discussing

We can't avoid the unforeseen from taking place, but often we can shield ourselves and our families from the most awful of the monetary after effects. Picking the right type as well as amount of insurance policy is based on your details situation, such as kids, age, lifestyle, and also employment benefits - https://www.gaiaonline.com/profiles/jstinsurance1/46356657/. 4 kinds of insurance that many economists advise include life, health and wellness, auto, and long-term disability.Health and wellness insurance policy shields you from devastating costs in case of a serious mishap or ailment. Auto insurance coverage avoids you from bearing the monetary concern of an expensive accident.

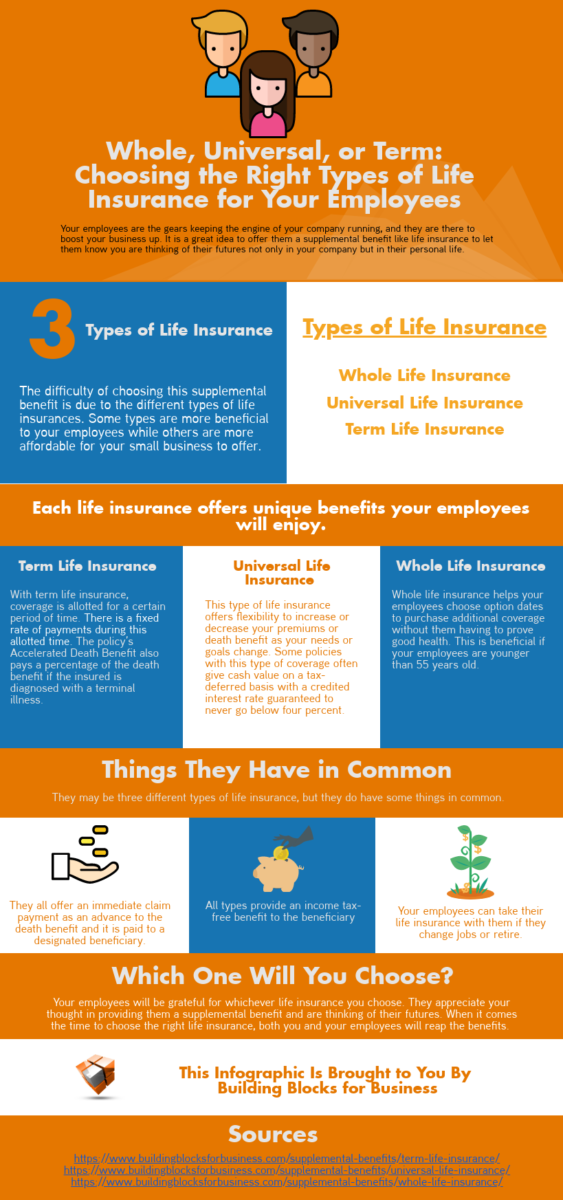

It includes a survivor benefit and also a money value part - https://hearthis.at/jstinsurance1/set/thomas-insurance-advisors/. As the worth grows, you can access the money by taking a funding or withdrawing funds as well as you can end the plan by taking the cash money value of the policy. Term life covers you for a collection amount of time like 10, 20, or 30 years and also your premiums stay stable.

Indicators on Thomas Insurance Advisors You Need To Know

Bureau of Labor Statistics, both partners functioned as well as brought in earnings in 48. Insurance in Toccoa, GA. 9% of married-couple families in 2022. This is up from 46. 8% in 2021. They would be likely to experience monetary difficulty as an outcome of among their wage earners' fatalities. Health and wellness insurance coverage can be gotten through your employer, the government wellness insurance policy industry, or exclusive insurance you buy for yourself and also your household by speaking to health insurance coverage firms directly or going through a wellness insurance coverage representative.

If your revenue is reduced, you may be one of the 80 million Americans who are qualified for Medicaid. If your income is moderate but does not extend to insurance protection, you may be eligible for subsidized insurance coverage under the government Affordable Care Act. The finest as More Help well as least costly alternative for employed workers is usually joining your employer's insurance coverage program if your company has one.

According to the Social Security Management, one in four employees going into the labor force will come to be handicapped prior to they get to the age of retirement. Home Owners Insurance in Toccoa, GA. While health and wellness insurance policy pays for hospitalization as well as medical bills, you are typically strained with all of the expenses that your paycheck had covered.

Thomas Insurance Advisors for Dummies

This would be the best choice for securing budget friendly special needs coverage. If your company doesn't supply lasting protection, right here are some things to think about before acquiring insurance coverage by yourself: A plan that guarantees income replacement is ideal. Numerous plans pay 40% to 70% of your income. The expense of special needs insurance policy is based upon many variables, including age, way of life, as well as health.Lots of plans need a three-month waiting duration before the insurance coverage kicks in, offer an optimum of 3 years' worth of protection, as well as have considerable plan exemptions. Here are your options when acquiring cars and truck insurance coverage: Liability coverage: Pays for home damages and also injuries you trigger to others if you're at fault for an accident and additionally covers litigation costs as well as judgments or settlements if you're filed a claim against due to the fact that of an automobile crash.

Comprehensive insurance coverage covers theft and also damage to your vehicle as a result of floodings, hail storm, fire, vandalism, dropping things, and animal strikes. When you finance your vehicle or rent an auto, this sort of insurance is mandatory. Uninsured/underinsured vehicle driver () insurance coverage: If an uninsured or underinsured chauffeur strikes your vehicle, this coverage spends for you as well as your passenger's clinical expenses as well as might additionally account for lost earnings or compensate for discomfort as well as suffering.

Some Of Thomas Insurance Advisors

Clinical repayment protection: Medication, Pay protection aids spend for medical expenditures, usually between $1,000 and also $5,000 for you and also your guests if you're wounded in a crash. Similar to all insurance policy, your conditions will certainly figure out the expense. Compare several price quotes and also the protection offered, and examine occasionally to see if you get approved for a reduced rate based upon your age, driving document, or the area where you live.Company insurance coverage is usually the very best option, yet if that is inaccessible, get quotes from several suppliers as numerous provide price cuts if you buy more than one kind of protection.

There are many different insurance policy policies, as well as understanding which is appropriate for you can be challenging. This guide will certainly review the different kinds of insurance as well as what they cover.

Depending upon the plan, it can also cover dental and vision treatment. When choosing a medical insurance policy, you should consider your particular demands as well as the degree of coverage you require. Life insurance policy is a plan that pays an amount to your recipients when you die. It offers monetary protection for your enjoyed ones if you can not sustain them.

Report this wiki page